Automotive Financing

For the vast majority of people, having a car is an essential need. However, it is often the case that a bad credit file can complicate the acquisition process. Whether it is due to a divorce, a difficult period, a job loss, late payments, a past vehicle repossession, a consumer proposal or bankruptcy, these different situations mean that you do not have access to regular credit from a bank or an automobile manufacturer. Iceberg Finance is a lender who understands these situations and our unique auto financing program certainly meets these specific needs!

- Non-Prime Financing

- 3 financing programs: Gold-Silver-Bronze

- Interest rates from 12.99% to 29.99% depending on the borrower’s credit risk

- Financing terms between 12 and 84 months

- Financing up to $35,000 taxes included

- Financing of extended warranties from several providers with your car loan

- Financing of insurance products with your car loan

- Competitive dealer reserves

- Quick and easy approval process

- Exclusive fidelity program for all our partners, dealers and merchants

Our IF Xpress program offers financing solutions for personal loans between $1 000 and $7 500. Talk to your merchant to get one of these loans quickly !

Loans between $1,000 and $7,500

- Interest rates from 12.99% to 29.99% depending on the borrower’s credit risk

- Financing terms between 24 and 60 months

- No responsibility for the dealer or merchant

- No proof of purchase required

- No hidden fees or administration fees

- Open loan payable at any time, at no additional cost

Useful for:

- A down payment

- Cover a negative equity

- Maintain the profit margin of a transaction

- Sale of parts, accessories and equipments

- Finance vehicle repairs

- Finance automobile, recreational and leisure vehicles

- Other products and services

Financing of Insurance Products and Extended Warranties

Finance your insurance products or extended warranties on a separate loan.

Insurance Products Financing

Financing of a life insurance, critical illness and disability insurance, replacement insurance and extended warranties on a separate loan.

Loan Terms

Loan terms between 18 and 72 months.

The Iceberg Finance Commitment

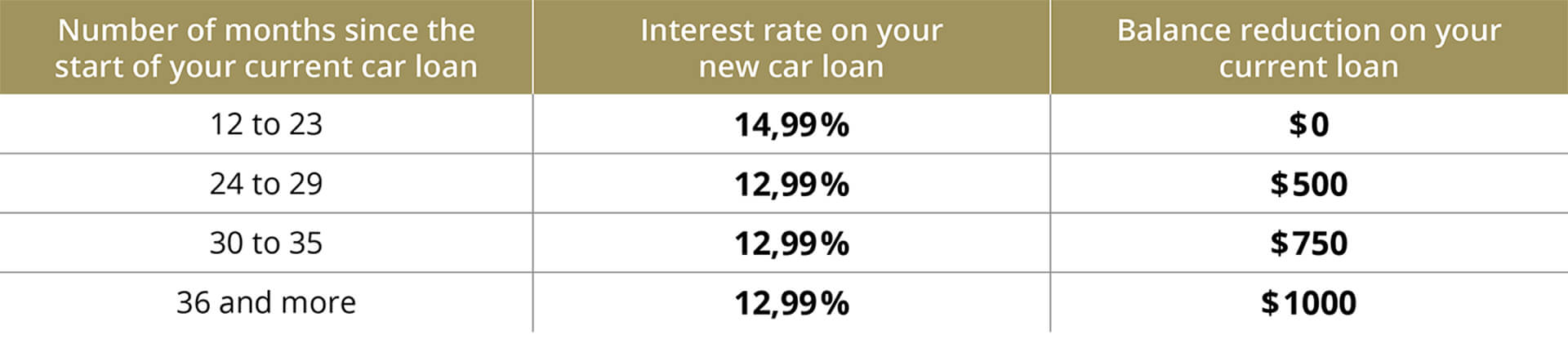

The objectives of this program are to reward good payment habits of customers and thus contribute to their financial autonomy, in addition to supporting the business development of our partner dealers and merchants by allowing them to do recurring business with their clients whose credit is on the road to recovery.

How ?

By reducing the balance owed on your current car loan and by reducing the interest rate on your new car loan*.

*Certain conditions apply

The Iceberg Finance Recognition Program

The Iceberg Finance recognition program aims to reward dealers and merchants doing business with Iceberg Finance by distributing free payments which can be given to future customers. These free payments are distributed to dealers and merchants when they reach certain levels of monthly sales. In addition to being beneficial to dealers and merchants, this program is equally beneficial to customers.

In fact, customers who have earned a free payment will be able to take advantage of it by paying other debts or simply paying other financial obligations, which in turn will help improve their credit file and personal finances.